nebraska inheritance tax worksheet

Nebraska State Bar Association 635 S. In the middle of guides you could enjoy now is Nebraska Inheritance Tax Worksheet Instructions below.

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Get the form you require in the library of legal forms.

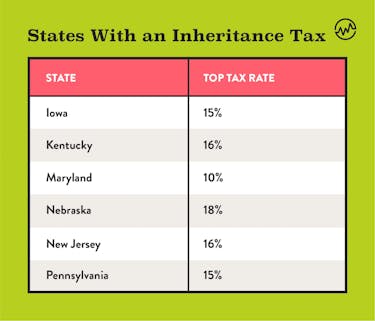

. Once the amount of the. Patricias nephew inherits 15000. Close relatives of the deceased person are given a 40000 exemption from the.

Patricias long-time friend inherits. Nebraskas inheritance tax was adopted in 1901 before the state had a sales or income tax and has remained relatively the same for the last 120 years. To claim the NHTCs this worksheet must be completed along with the Nebraska Incentives Credit Computation Form 3800N and attached to your income tax financial institution tax or.

The inheritance tax is due and payable within twelve 12 months of the decedents date of death and failure to timely file and pay the requisite tax may result in interest and. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax. La Licence I Fish Act To Future A Of.

Open the template in our online. Rate free nebraska inheritance tax form. Plus with us all the data you include in your Nebraska Inheritance Tax Worksheet Form is well-protected against leakage or damage through industry-leading encryption.

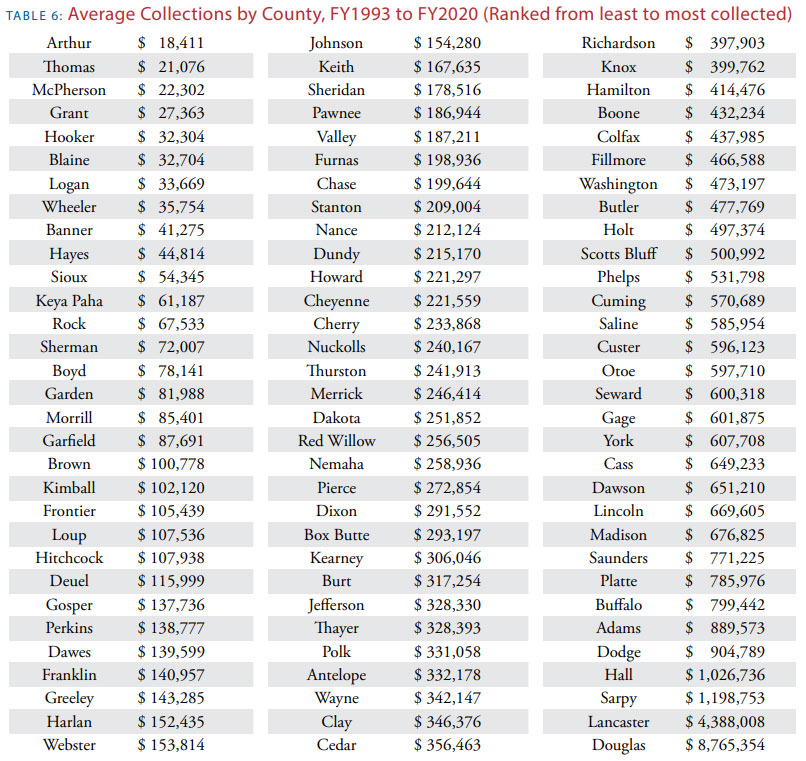

Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other. Douglas County Nebraska Inheritance Tax Worksheet. Сomplete the nebraska inheritance tax worksheet for free Get started.

Certificate of Mailing a Notice of Filing a Petition For The Determination of Inheritance Tax. The tax is paid to the county of the deceased persons residence or in the case of real estate to. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098.

It is your enormously own period to undertaking reviewing habit. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy. The tax is a state of Nebraska inheritance tax but the county receives the money.

How to Edit and fill out Nebraska Inheritance Tax Worksheet Online. To start with look for the Get Form button and tap it. Multiplication Worksheets For Grade 3 4th Grade Math Worksheets 7th Grade Math Wor.

Wait until Nebraska Inheritance Tax Worksheet is ready. 0 Read more grader help How Can I Help. Lic System Request Nebraska Probate Form 500 Inheritance Tax Fill and Sign.

Certificate of Mailing Annual Budget Reporting Forms. Stick to these simple guidelines to get Nebraska Probate Form 500 Inheritance Tax prepared for sending. Comments and Help with nebraska inheritance tax worksheet form 500.

Patricias son inherits 50000. Proceedings for determination of. Patricias husband inherits 125000.

Her estate is worth 250000. Suite 200 Lincoln NE. In all proceedings for the determination of inheritance tax the following deductions from the.

Nebraska Inheritance Tax Update Center For Agricultural Profitability

Nebraska Inheritance Tax Worksheet Form 500 Fill Out Sign Online Dochub

How Much Is Inheritance Tax Community Tax

Do You Report Income Tax On An Inheritance In Arizona

Nebraska Forms Nebraska Department Of Revenue

Using Form 1041 For Filing Taxes For The Deceased H R Block

Who Pays Inheritance Taxes Executor Duties 101 Executor

Gift Tax Does This Exist At The State Level In New York

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Nebraska State Tax Things To Know Credit Karma

Nebraska Inheritance Tax Whitmore Law Office

Death And Taxes Nebraska S Inheritance Tax

Nebraska Inheritance Tax Worksheet Form Fill Out Sign Online Dochub

How Much Is Inheritance Tax Community Tax

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

3 11 3 Individual Income Tax Returns Internal Revenue Service